income tax return malaysia

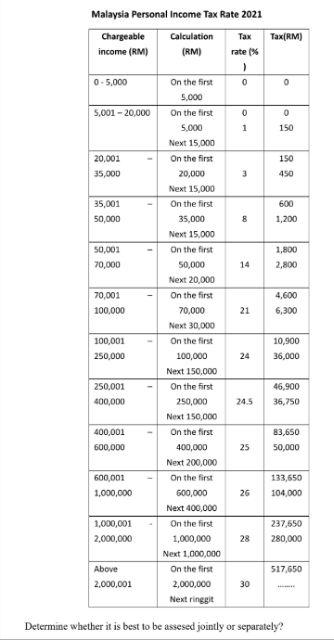

Corporate - Taxes on corporate income. 13 rows 30.

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

The IRBM Clients Charter sets that tax refund will be processed.

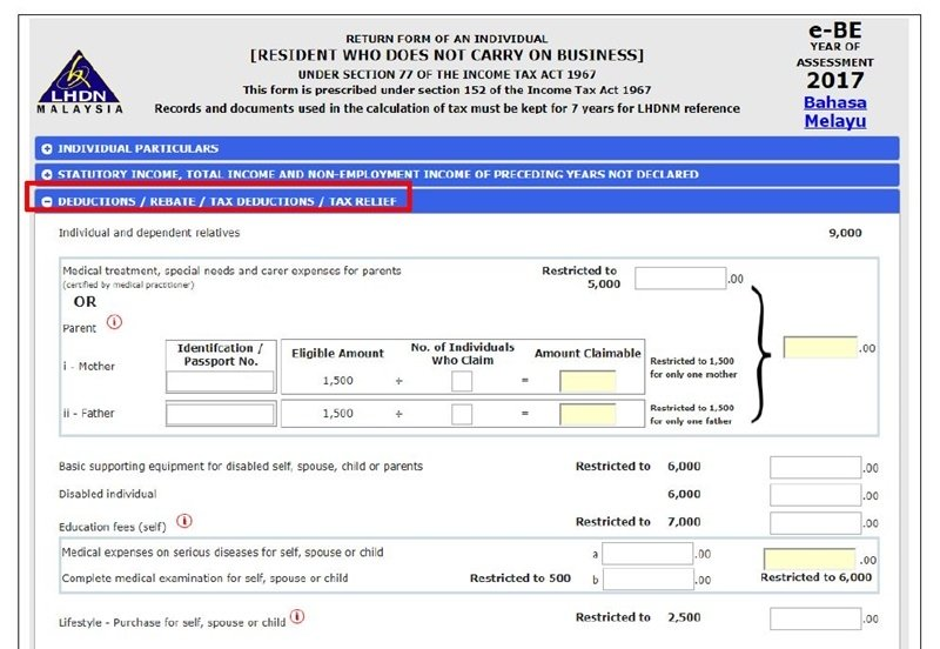

. The total deduction under this relief is restricted to RM3000 for an individual and RM3000 for a spouse who has a source of income. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. The amount of increase in tax charged for an Amended Return Form furnished within a.

What is the minimum salary to pay income tax in Malaysia. Most taxpayers receive their refunds within 21 days of filing. If you choose to have your refund deposited directly into your account you may have to wait five days before you can.

Tax returns Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30. Malaysia unveiled a leaner budget of RM3723 billion US8006 billion for 2023 on Friday Oct 7 amid an uncertain global environment and an expected slow.

If you are using income tax e-Filing to file your tax and you provide your bank account details correctly you will be getting your refund credited directly into their bank. For both resident and non-resident companies corporate income tax CIT is imposed on income. Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

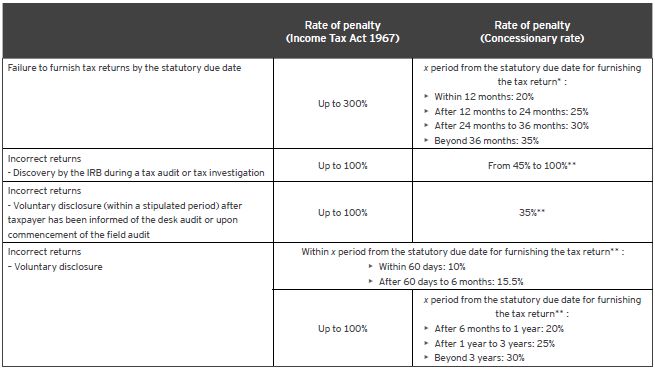

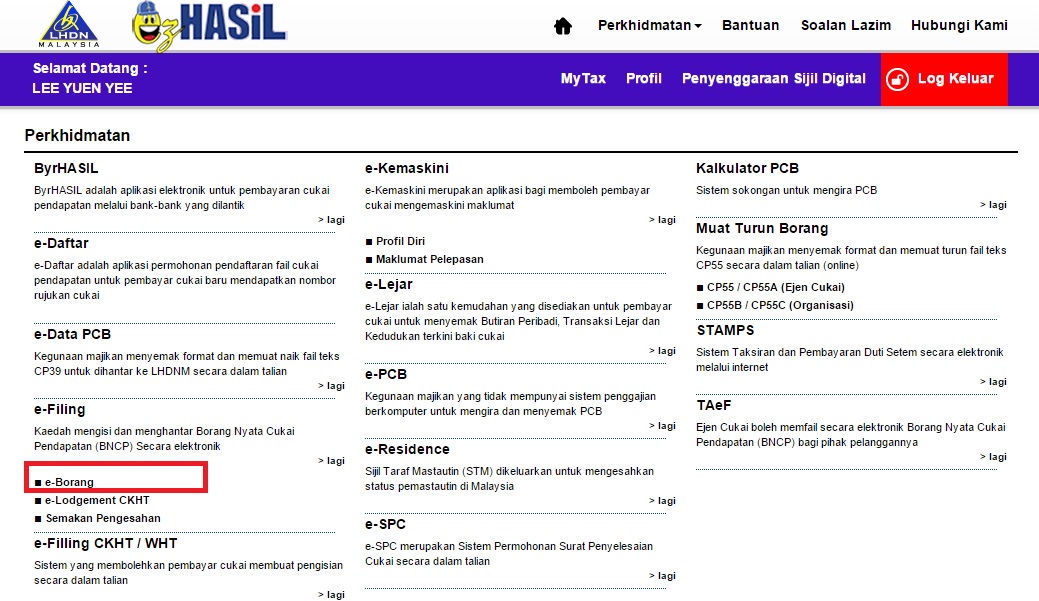

Click on Permohonan or Application depending on. Offences Fines and Penalties. Guide To Using LHDN e-Filing To File Your Income Tax.

The tax filing deadline for person not carrying on a business is by 30. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. How To Pay Your Income Tax In.

To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. Within 30 working days after e-Filing submission.

On the First 20000 Next. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for. Criteria on Incomplete ITRF.

Last reviewed - 13 June 2022. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. Dialog Minutes For Operational.

If you elect for joint assessment of income. Any individual earns a minimum of RM 34000 after EPF deductions. A non-resident individual is taxed at a flat rate of.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Within 90 working days after manual submission. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis.

Visit your nearest IRB branch if you need help to complete your income tax return form or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas. It means individuals who earn RM 2833 per. On the First 5000 Next 15000.

Normally companies will obtain the income tax. Kindly click on the following link. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable.

Calculations RM Rate TaxRM 0 - 5000. On the First 5000. In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing.

If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

Malaysia Personal Income Tax Guide 2020 Ya 2019

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

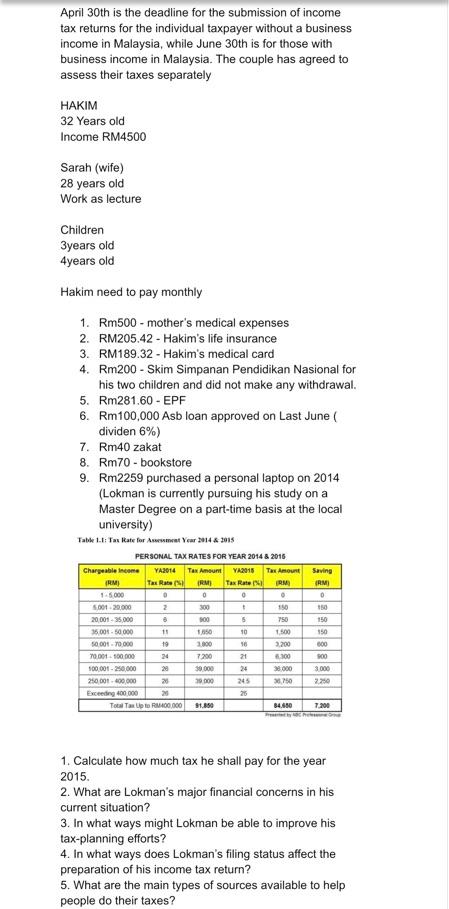

April 30th Is The Deadline For The Submission Of Chegg Com

Company Malaysian Taxation 101

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Individual Income Tax In Malaysia For Expatriates

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Step By Step Income Tax E Filing Guide Imoney

Guide To Using Lhdn E Filing To File Your Income Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

13 Ehsan S Family Wants To Submit Lhdn Return Form Chegg Com

E Filing Due Date 2020 Malaysia Tax Compliance Statutory Due Dates For May 2022

Do You Need To File A Tax Return In 2018

7 Tips To File Malaysian Income Tax For Beginners

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Comments

Post a Comment